The Charging Authority

The Charging Authority is Three Rivers District Council

Date of Approval

This Charging Schedule was approved by the Council on 24 February

2015.

Date of Effect

This Charging Schedule will come into effect on 1 April 2015

CIL Rates

The rate at which CIL is charged shall be:

| Residential Developments |

| Area |

CIL Rate (per sqm) |

| Area A (Use Class C3) |

£180 |

| Area B (Use Class C3) |

£120 |

| Area C (Use Class C3) |

£Nil |

| Other Developments |

| Type |

CIL Rate (per sqm) |

Area A and Area B –

Retail

(Use Class A1) |

£60 |

Area C – Retail

(Use Class A1) |

£Nil |

| Hotels (Use Class C1) |

£Nil |

Retirement Housing*

(Use

Class C3) |

£Nil |

| Other non residential |

£Nil |

| *Retirement Housing

is housing which is purpose built or converted for sale to elderly

people with a package of estate management services and which consists

of grouped, self-contained accommodation with communal facilities.

These premises often have emergency alarm systems and/or wardens.

These properties would not however be subject to significant levels

of residential care as would be expected in care homes or extra

care premises (C2). For the avoidance of doubt this excludes

registered not for profit care homes. |

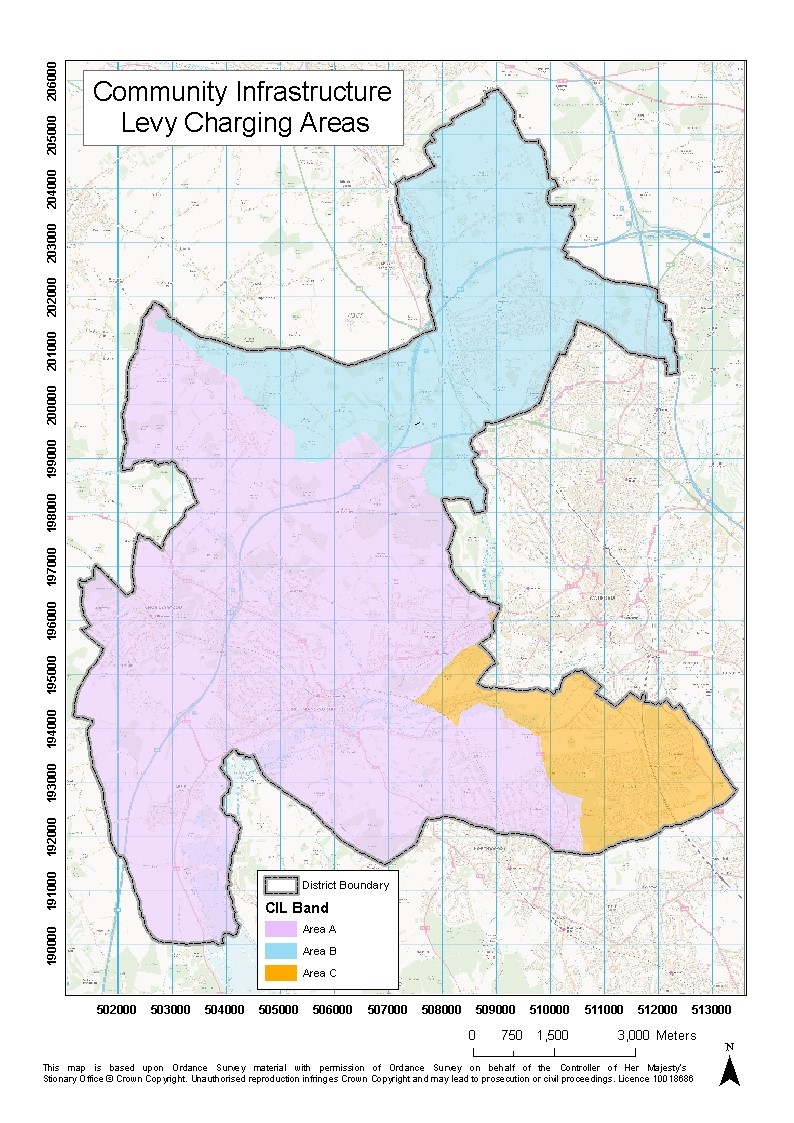

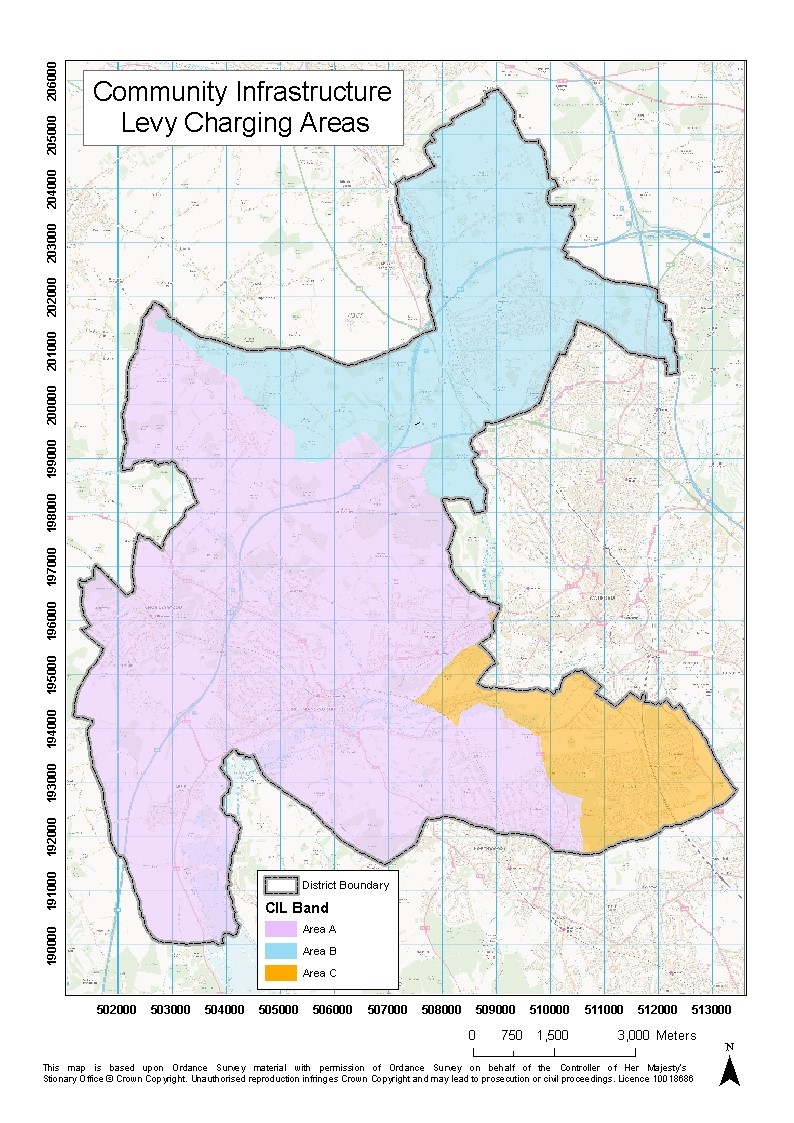

The Charging Areas

The Charging Areas A, B & C are defined in the 'Community infrastructure

Levy Charging Areas' Map in Annex 1 of this Schedule.

Calculating the Chargeable Amount

The Council will calculate the amount of CIL payable ('chargeable

amount') in respect of a chargeable development in accordance with Regulation

40 of the Community Infrastructure Levy Regulations 2010 (amended 2014),

see Annex 2 for calculation.

Statutory Compliance

The Charging Schedule has been published in accordance with the Community

Infrastructure levy Regulations 2010 (as amended) and Part 11 of the

Planning Act 2008.

Annex 1

Annex 2 Calculation of Chargeable Amount

Regulation 40 of the Community Infrastructure Regulations 2010, as

amended in 2014

PART 5

CHARGEABLE AMOUNT

Calculation of chargeable amount

40.

- The collecting authority must calculate the amount of CIL

payable (“chargeable amount”) in respect of a chargeable

development in accordance with this regulation.

- The chargeable amount is an amount equal to the aggregate

of the amounts of CIL chargeable at each of the relevant rates.

- But where that amount is less than £50 the chargeable

amount is deemed to be zero.

- The relevant rates are the rates taken from the charging

schedules, at which CIL is chargeable in respect of the chargeable

development.

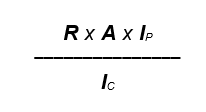

- The amount of CIL chargeable at a given relevant rate (R)

must be calculated by applying the following formula

where—

A = the deemed net area chargeable at rate R, calculated in accordance

with paragraph (7);

IP = the index figure for the year in which planning

permission was granted; and

IC = the index figure for the year in which the charging

schedule containing rate R took effect.

- In this regulation the index figure for a given year is —

- the figure for 1st November for the preceding year in

the national All-in Tender Price Index published from time

to time by the Building Cost Information Service of the

Royal Institution of Chartered Surveyors (a)

- if the All-in Tender Price Index ceases to be published,

the figure for 1st November for the preceding year in the

retail prices index.

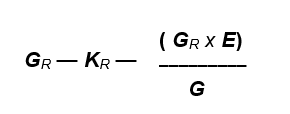

- The value of A must be calculated by applying the following

formula—

where—

G = the gross internal area of the chargeable development;

GR = the gross internal area of the part of the chargeable

development chargeable at rate R;

KR = the aggregate of the gross internal areas of

the following—

- retained parts of in-use buildings, and

- for other relevant buildings, retained parts where the intended

use following completion of the chargeable development is a

use that is able to be carried on lawfully and permanently without

further planning permission in that part on the day before planning

permission first permits the chargeable development:

E = the aggregate of the following —

- the gross internal areas of parts of in-use buildings that

are to be demolished before completion of the chargeable development,

and

- for the second and subsequent phases of a phased planning

permission, the value Ex (as determined under paragraph (8)),

unless Ex is negative

provided that no part of any building may be taken into account

under both of paragraphs (i) and (ii) above.

- The value Ex must be calculated by applying the following

formula —

EP

– (GP

– KPR)

where—

EP = the value of E for the previously commenced phase

of the planning permission:

GP = the value of G for the previously commenced phase

of the planning permission; and

KPR = the total of the values of KR for the previously

commenced phase of the planning permission.

- Where a collecting authority does not have sufficient information,

or information of sufficient quality, to enable it to establish

that a relevant building is an in-use building, it may deem

it not to be an in-use building.

- Where a collecting authority does not have sufficient information,

or information of sufficient quality, to enable it to establish—

- whether part of a building falls within the description

in the definitions of KR and E in paragraph

(7): or

- the gross internal area of any part of a building falling

within such a description,

it may deem the gross internal area of the part in question to

be zero.

- In this regulation—

“building” does not include—

- a building into which people do not normally go,

- a building into which people go only intermittently for the

purpose of maintaining or inspecting machinery, or

- a building for which planning permission was granted for

a limited period;

“in-use building” means a building which—

(i) is a relevant building, and

(ii) contains a part that has

been in lawful use for a continuous period of at least six months

within the period of three years ending on the day planning

permission first permits the chargeable development:

“new build” means that part of the chargeable

development which will comprise new buildings and enlargements

to existing buildings;

“relevant building” means a building which is situated

on the relevant land on the day planning permission first permits

the chargeable development;

“relevant charging schedules” means the charging

schedules which are in effect —

- at the time planning permission first permits the chargeable

development, and

- in the area in which the chargeable development will be situated:

“retained part” means part of a building which will

be—

- on the relevant land on completion of the chargeable development

(excluding new build),

- part of the chargeable development on completion, and

- chargeable at rate R.

_____________________________

(a) Registered in England and Wales RC00487 |